- Home

- Accounting

- 1099 Processing

1099 Processing

This FAQ goes over how to use the 1099 processing tool.

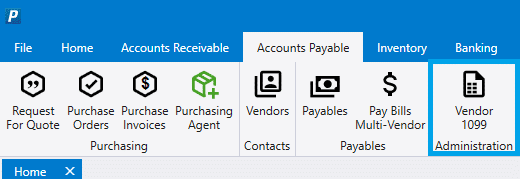

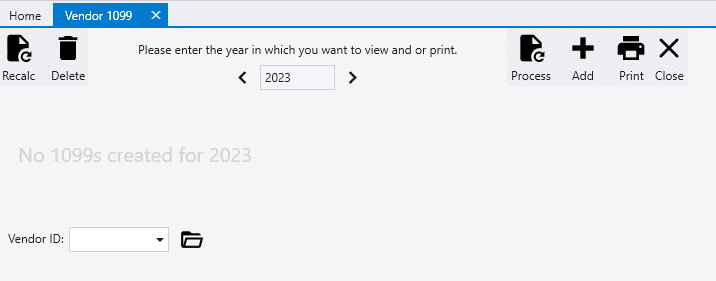

- To get to 1099 processing, go to Accounts Payable > Vendor 1099

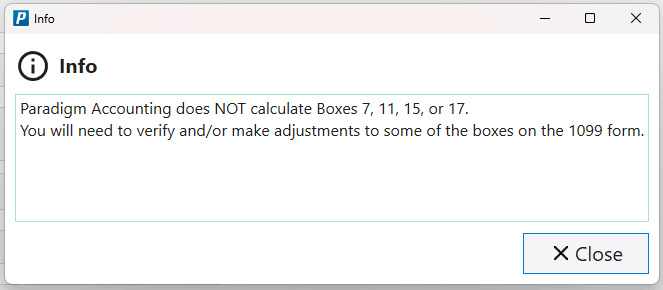

- The following pop up will then appear: Paradigm Accounting does NOT calculate Boxes 7, 11, 15, or 17. You will need to verify and/or make adjustments to some of the boxes on the 1099 form.

Creating 1099 Forms

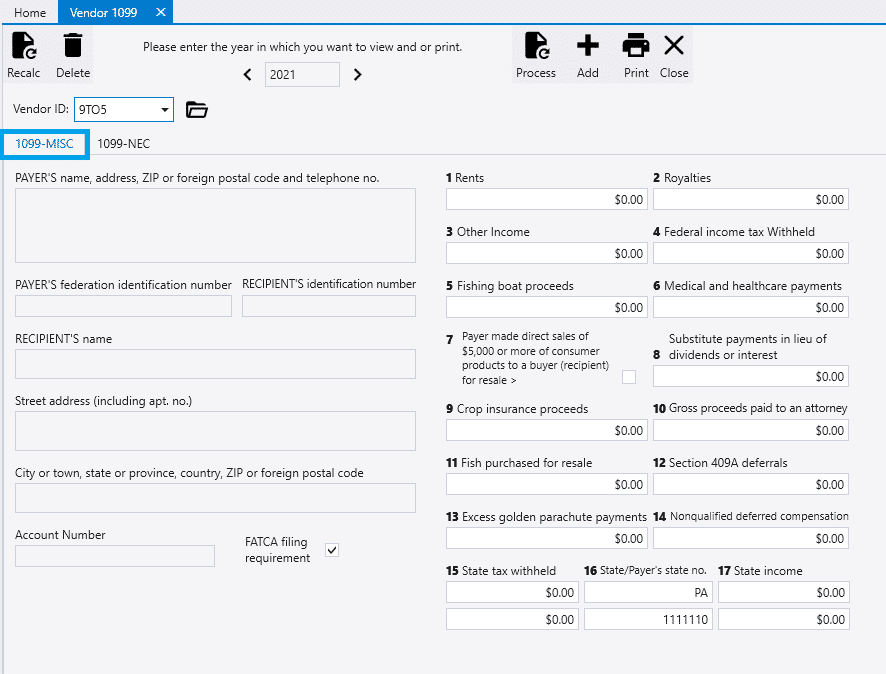

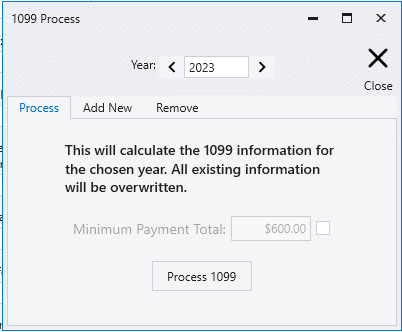

- To create the 1099 Forms, select the desired year and click the “Process” button.

- Then select the vendor from the Vendor ID drop down and all the 1099 information for that vendor will appear.

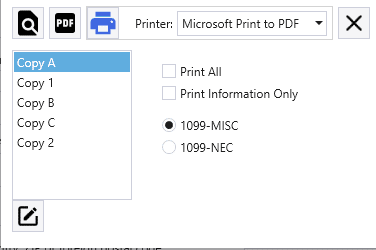

The first tab shows the 1099-MISC form, which is used in the reporting of payments that are not subject to self-employment tax – things like rents and prizes.

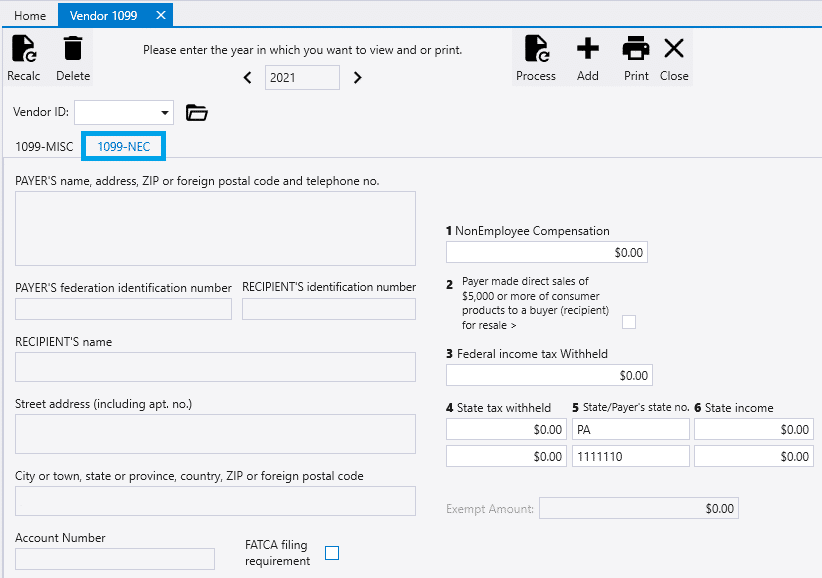

On the other tab is 1099-NEC, which is used for reporting non-employee compensation that is most likely subject to self-employment tax.

1099 Processing Options

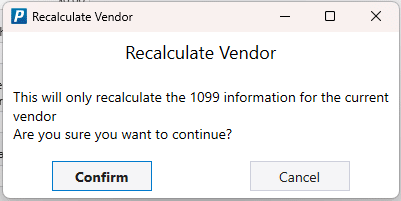

- Recalc – Recalculate 1099s for a given year.

- Delete – Deletes the selected 1099 record.

- Process – Create the 1099s for the selected year.

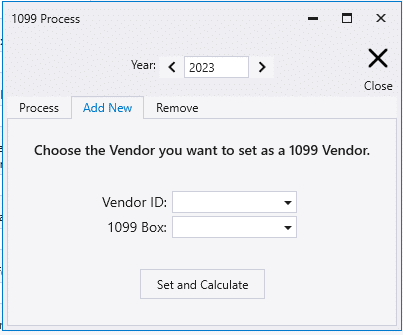

- Add – Set a Vendor as a 1099 Vendor and assign the default 1099 box selected. The selected box is also applied to that vendor’s transactions from the year.

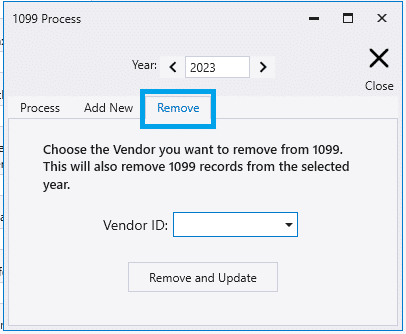

- From here the remove tab can reached, where vendors can be removed from the 1099 records.

- Print – Print or view the selected 1099 form.

- Close – Closes the 1099 module

Contents

Categories

- Purchase Order and Vendors (20)

- Production (37)

- Order Entry and Customers (79)

- NEW! (8)

- Job Costing (16)

- Inventory and Pricing (96)

- General (57)

- Fulfillment Pro (30)

- Dispatching (24)

- Administration and Setup (43)

- Add-Ons and Integrations (31)

- Accounting (55)