- Home

- Accounting

- Loans

Loans

This FAQ will go over how to record a loan balance and paying the loan.

Create GL Accounts

The first step is to create a GL liability account for each loan. More information on creating GL accounts can be found here: Create GL Accounts

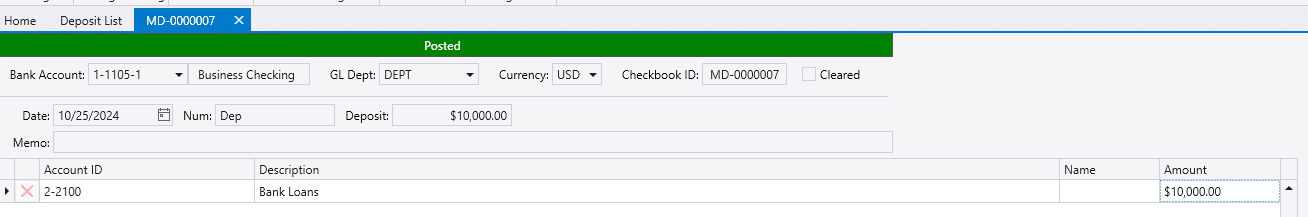

Entering The Loan Balance

To enter the loan opening balance, create a deposit to the asset account given for the loan (bank, equipment, etc.). The Account ID selected on the deposit detail line should the liability account created for the loan.

If the loan is a part of a purchase and you never receive the actual funds, use a journal entry to credit the loan account with the beginning balance of the loan, and debit the asset or expense account associated with the purchase.

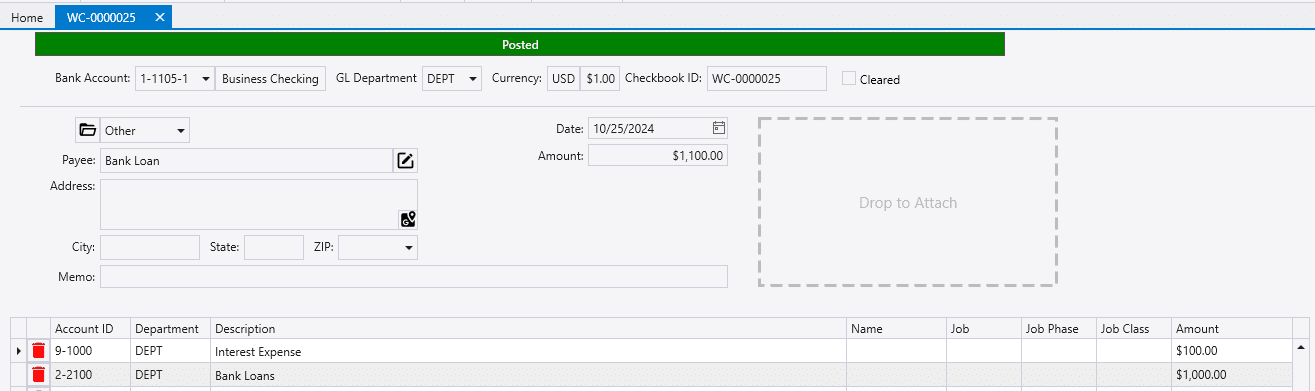

Paying The Loan Balance

To record paying the loan balance, a favorited withdrawal can be made. Each month the withdrawal can be created from the favorited transaction, when the loan payment is made.

Set up the withdrawal from the bank account used to make the loan payment. The principal amount should be recorded on a detail line referencing the loan liability account, and the interest amount should be record on a line referencing an interest expense account.

Contents

Categories

- Purchase Order and Vendors (20)

- Production (37)

- Order Entry and Customers (79)

- NEW! (8)

- Job Costing (16)

- Inventory and Pricing (96)

- General (57)

- Fulfillment Pro (30)

- Dispatching (24)

- Administration and Setup (43)

- Add-Ons and Integrations (31)

- Accounting (55)