- Home

- Accounting

- Closing A Fiscal Year

Closing A Fiscal Year

This FAQ will go over how to close a fiscal year.

Closing a fiscal year is a process that is typically done once annually, after the accounting entries to finalize the prior fiscal year have been completed. Closing a fiscal year cannot be undone, so make sure all entries are indeed finalized and correct in Paradigm before continuing.

The fiscal year close process summarizes all of the GL entries from that period and enters them as the opening balances for the next fiscal year. Profit is summarized and moved from Current Year Earnings to Retained Earnings as of the first day in the fiscal period.

It is strongly recommend that a database backup be taken before doing the fiscal year close, in case something causes the archive to fail. Closing a fiscal year is very resource intensive on the server and can cause the rest of Paradigm to lag or stop working while the close is running. Because of this, most clients have Paragon take care of closing fiscal periods after-hours for them.

It is also recommended to export a balance sheet and profit and loss as of the last day of the fiscal year, then close the year, then run the reports again to verify that no totals have changed.

How to Close A Fiscal Year

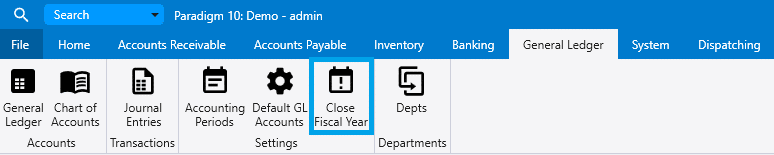

First, go to General Ledger > Close Fiscal Year

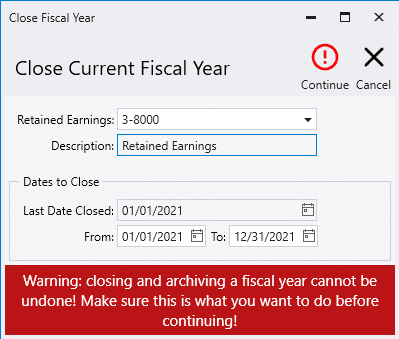

Then select a retained earnings account and the date range to close. Once those are selected, click “Continue”.

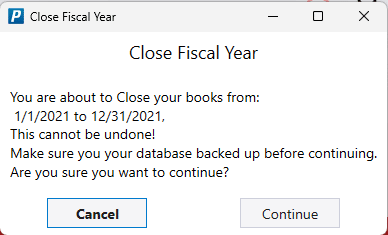

Then verify that the dates entered are correct and click “Continue”.

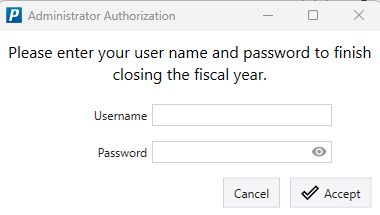

Enter the user name and password.

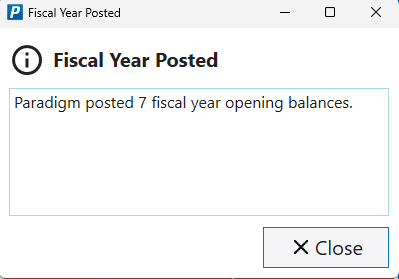

A pop up will then appear with a message about how many opening balances were closed.

Contents

Categories

- Purchase Order and Vendors (19)

- Production (34)

- Order Entry and Customers (75)

- NEW! (6)

- Job Costing (16)

- Inventory and Pricing (92)

- General (54)

- Fulfillment Pro (29)

- Dispatching (23)

- Administration and Setup (39)

- Add-Ons and Integrations (29)

- Accounting (51)