- Home

- Accounting

- Journal Entry Import Format

Journal Entry Import Format

General ledger journal entries can be imported into Paradigm from a .csv text file. The import file has two different formats, one for header entries and another for detail entries.

Import Formats

Header Line

LineType,Date,Reference,GLDepartmentCode

Example: H,01/20/2019,Payroll Import,DEPT

Detail Line

LineType, GLAccountNumber, GLDepartmentCode,Description,Debit, Credit

Example: D,1-1100,DEPT,Net Payroll From Checking,0,5510.25

Header Fields

LineType – Must be a value of “H” to indicate a Header line.

Date – The posting date of the journal entry in MM/DD/YYYY format. Entering “[TODAY]” will use the current date.

Reference – The description of the journal entry.

GLDepartmentCode – (Optional) – A GL Department code that matches a Paradigm GL Department code.

Detail Fields

LineType – Must be a value of “D” to indicate a Detail Line.

GLAccountNumber – A GL Account Number that matches a GL Account number found in the Paradigm Chart of Accounts.

GLDepartment – A GL Department code that matches a Paradigm GL Department code. If blank, the default department will be assigned by the import procedure.

Description – The description or memo for the journal line. These description can not contain commas.

Debit – The line item amount if it’s a Debit line item.

Credit – The line item amount if its a Credit line item. (Note that a line item cannot contain both a Debit and Credit Amount. Use value of 0 for the field that does not contain an amount)

JobID – Optional – If used, it must match an existing Paradigm Job ID.

JobPhase – Optional – If used, it must match a phase for the provided Job ID.

Job Phase Classification – Optional – If used, it must match a classification for the Job Phase.

Importing Examples

The import file must start with a Header Line, followed by the associated Detail lines like the example below. A file may contain multiple Header/Detail sections, a new journal entry will be created for each one.

Example

H,01/20/2019,Payroll Import,DEPT

D,1-1100,DEPT,Net Payroll From Checking,0,5510.25

D,6-1140,DEPT,Payroll Wages,5100,0

D,6-1426,DEPT,Employer Tax Expense,410.25,0

Import Example with Job Info

H,1/20/2019,Payroll Import,DEPT

D,1-1100,DEPT,Net Payroll From Checking,0,5510.25,JOB-00000,Phase 1,Labor

D,6-1140,DEPT,Payroll Wages,5100,0,JOB-00000,Phase 1,Labor

D,6-1426,DEPT,Employer Tax Expense,410.25,0,JOB-00000,Phase 1,Labor

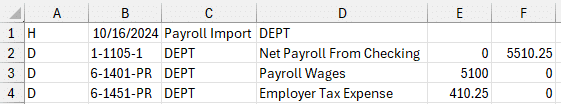

Excel .CSV File Example

Contents

Categories

- Purchase Order and Vendors (19)

- Production (34)

- Order Entry and Customers (75)

- NEW! (6)

- Job Costing (16)

- Inventory and Pricing (92)

- General (54)

- Fulfillment Pro (29)

- Dispatching (23)

- Administration and Setup (39)

- Add-Ons and Integrations (29)

- Accounting (51)