- Home

- Accounting

- Paying Sales Tax

Paying Sales Tax

This FAQ will go over how to record sales tax being paid in Paradigm. There is also a training video on how to do this, which can be found by going to Help > Training Videos > Accounting > Accounting Training – Paying Sales Tax

Set The Period Close Date

The first step is to set the accounting period close date by going to General Ledger > Accounting Periods. This is also a step of the month end close process.

Sales Tax Collected

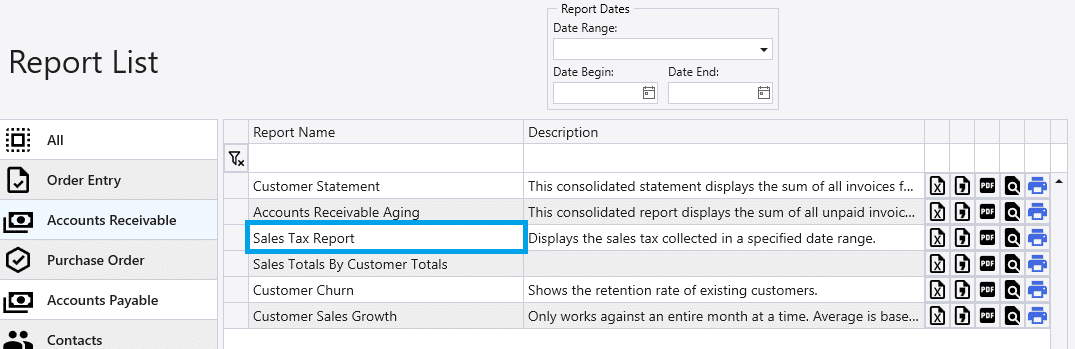

To see how much sales tax was collected, go to Reports > Accounts Receivable > Sales Tax Report

Record Paid Sales Tax

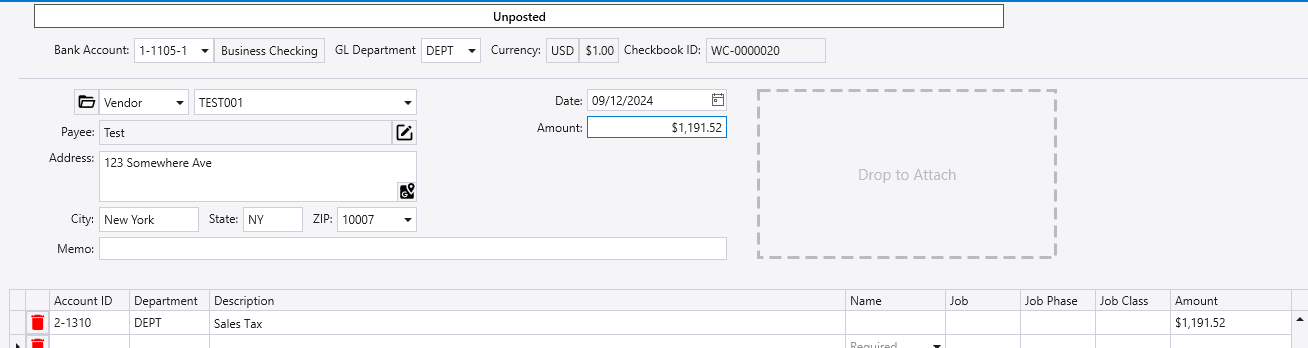

To record paying sales tax in Paradigm, create a withdrawal and set the vendor to the government office the tax is being paid to. The vendor’s default expense account should be set to the liability account that the tax is being paid from.

Add a line for the sales tax account, enter the sales tax amount paid, and post the withdrawal.

Contents

Categories

- Purchase Order and Vendors (20)

- Production (37)

- Order Entry and Customers (79)

- NEW! (8)

- Job Costing (16)

- Inventory and Pricing (96)

- General (57)

- Fulfillment Pro (30)

- Dispatching (24)

- Administration and Setup (43)

- Add-Ons and Integrations (31)

- Accounting (55)