- Home

- Accounting

- Sales Tax Code Set Up

Sales Tax Code Set Up

This FAQ will go over how to set up tax codes in Paradigm. Another way tax codes can be set up is by using Avalara’s AvaTax. More information on that can be found here: AvaTax

Sales Tax Collected

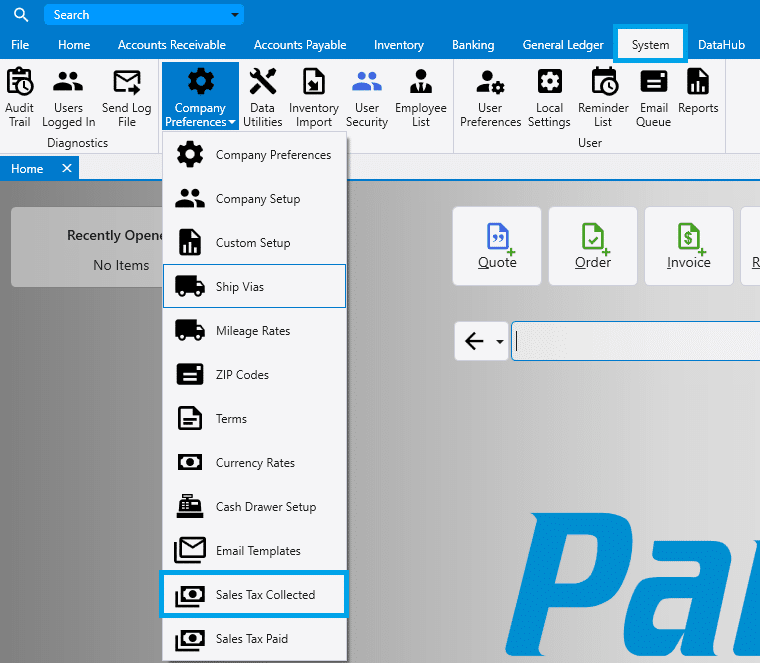

Sales tax codes for collected sales tax can be created and edited by going to System > Company Preferences dropdown > Sales Tax Collected. The tax codes set here can be used on AR transactions. (Orders, Invoices, etc.)

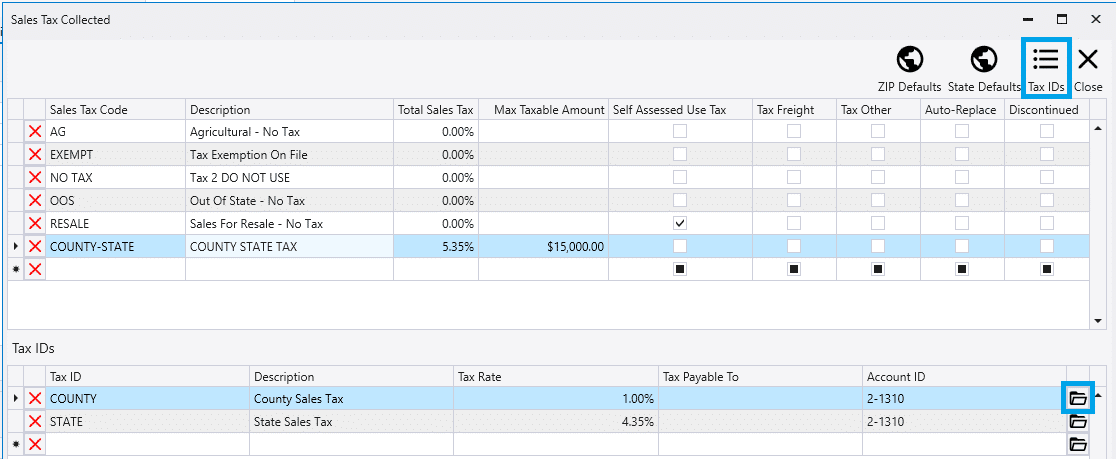

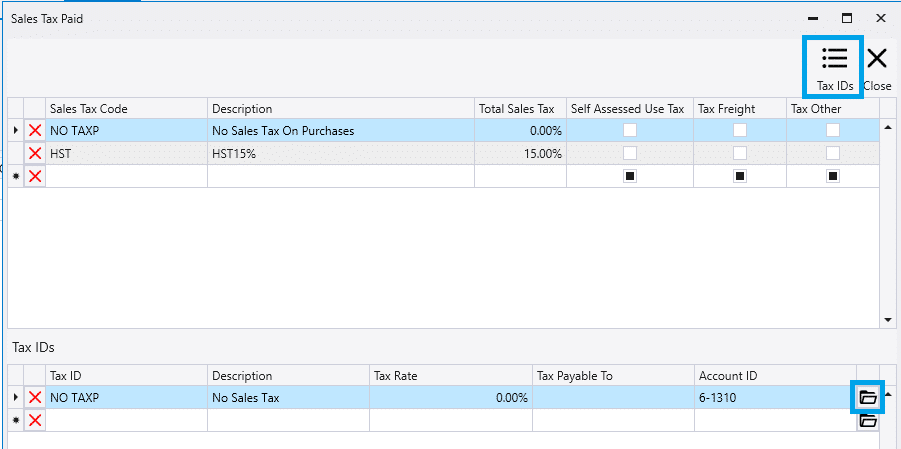

From here, sales tax codes can be created by entering the sales tax code at the top, and applying tax IDs in the bottom section. To create a new tax ID, click on the “Tax IDs” button at the top, or click on the folder icon in the bottom section.

Tax Code Checkbox Options

- Max Taxable Amount – The max amount that can be taxed on the transaction.

- Self Assessed Use Tax – Select whether or not it is a self assessed use tax.

- Tax Freight – Applies the tax code to the freight charge.

- Tax Other – Applies the tax code to the other charges.

- Auto-Replace – This is only used on 0% tax rates, and allows for the tax rate to be replaced by another State’s tax rate. This is used when the state that the company is based in has a 0% tax rate, but is shipping orders to states that do collect tax.

- Discontinued – Marks the tax code as discontinued.

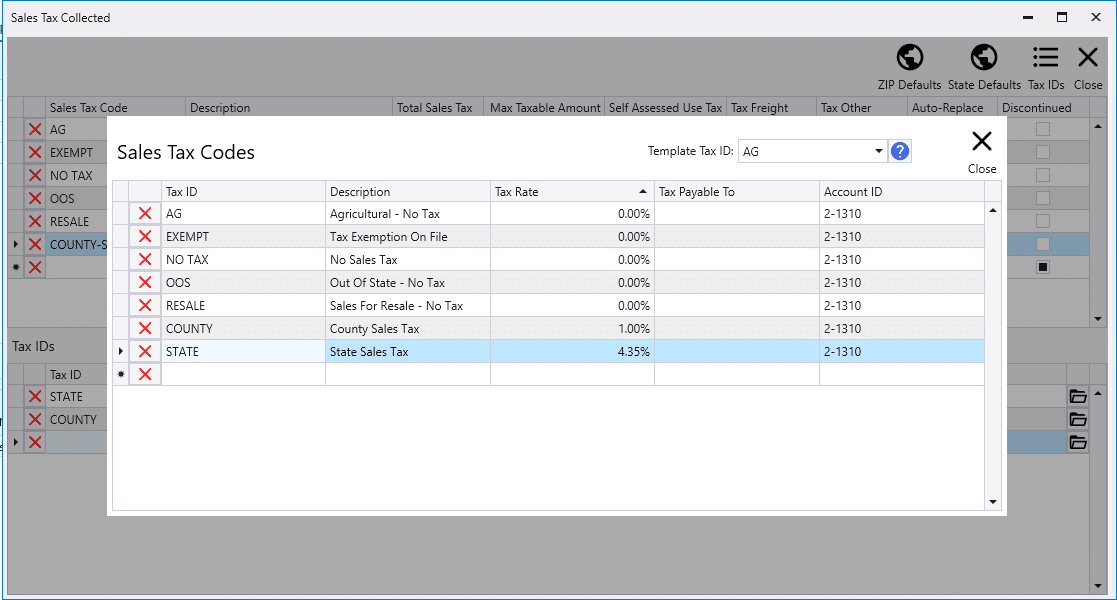

Template Tax ID

When creating new tax IDs, a template tax ID can be chosen from the drop down. Any new tax IDs will get default values from this template tax ID for class tax code settings. These are settings determining which classes of items will be taxable under this tax.

Sales Tax Collected Set Up Example

The below example shows a sale tax ID being created and assigned to a new tax code.

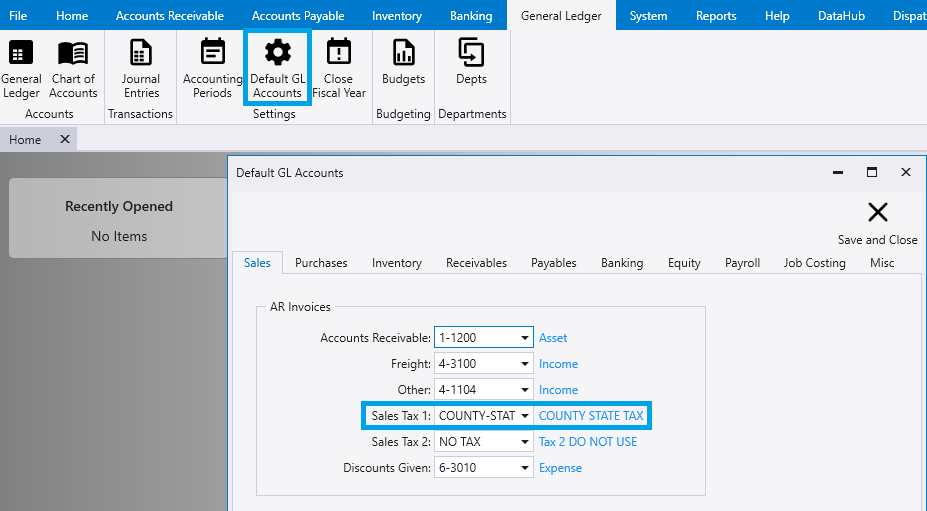

Default Sales Tax Code – Accounts Receivable

To set the default sales tax code for accounts receivable transactions, go to General Ledger > Default GL Accounts > Sales tab > Sales Tax 1

Sales Tax Paid

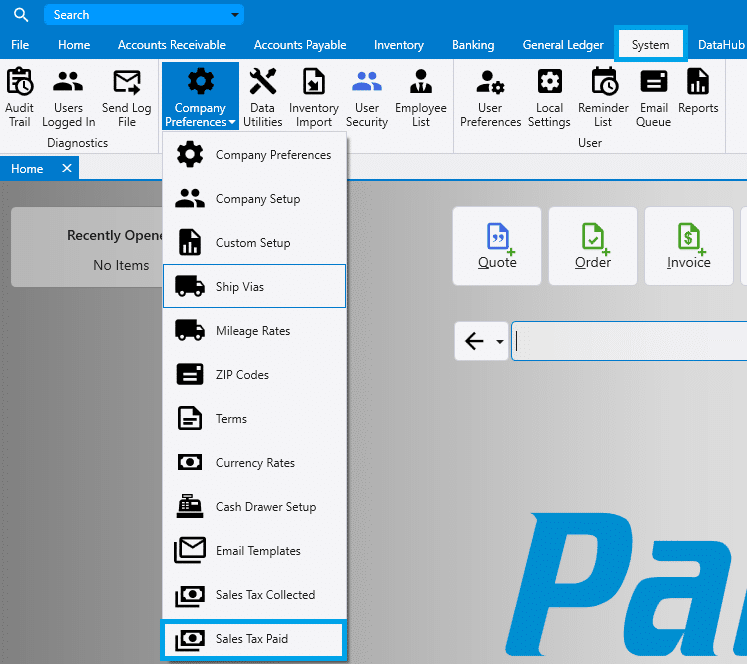

Sales tax paid are almost always use taxes, but are rarely needed. The tax codes for sales tax being paid can be created and edited by going to System > Company Preferences dropdown > Sales Tax Paid. The tax codes set here, will be used on AP transactions. (POs, Purchase Invoices, etc.)

From here, sales tax codes can be created by entering the sales tax code at the top, and applying a tax ID in the bottom section. To create a new tax ID, click on the “Tax IDs” button at the top, or click on the folder icon in the bottom section.

Default Sales Tax Code – Accounts Payable

To set the default sales tax code for accounts payable transactions, go to General Ledger > Default GL Accounts > Purchases tab > Sales Tax 1

Contents

Categories

- Purchase Order and Vendors (19)

- Production (34)

- Order Entry and Customers (75)

- NEW! (6)

- Job Costing (16)

- Inventory and Pricing (92)

- General (54)

- Fulfillment Pro (29)

- Dispatching (23)

- Administration and Setup (39)

- Add-Ons and Integrations (29)

- Accounting (51)